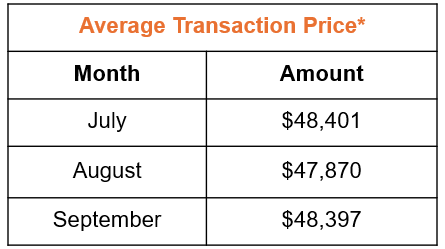

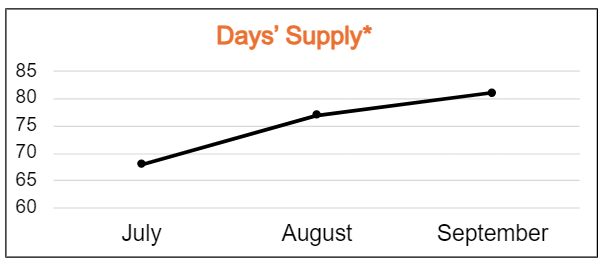

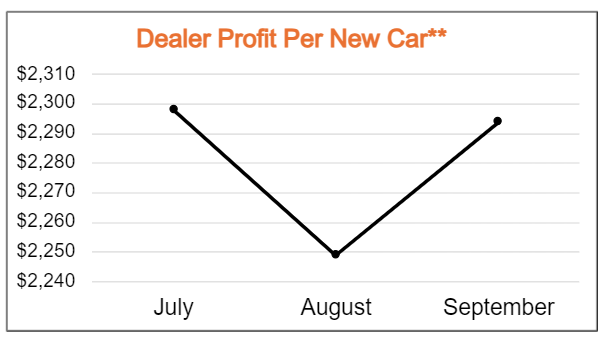

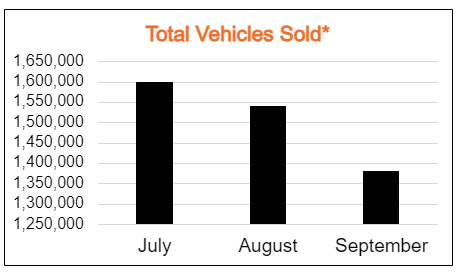

Q3 2024 New Car Insights

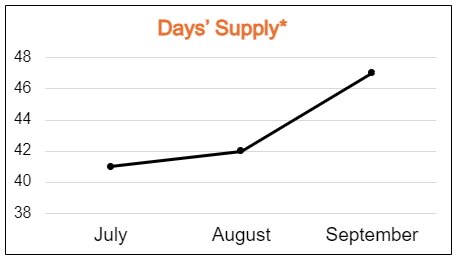

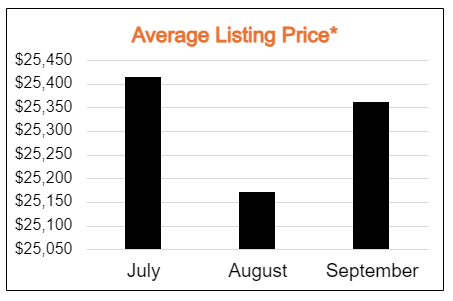

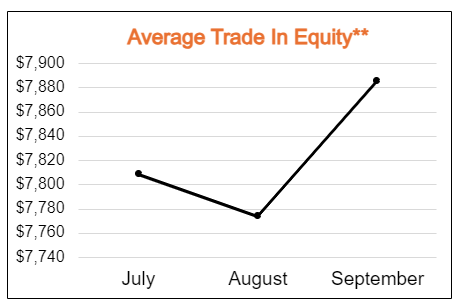

Read what we learned during Q3 below:

Q3 2024 Used Car Insights

Read what we learned during Q3 below:

Want more insights?

Dale Pollak: Like I See It

Read Dale Pollak’s take on what’s happening in the industry.

vAuto Podcast

Listen to hear perspectives from dealers and vAuto leaders.

Learn how we can partner with your dealership

"*" indicates required fields